|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

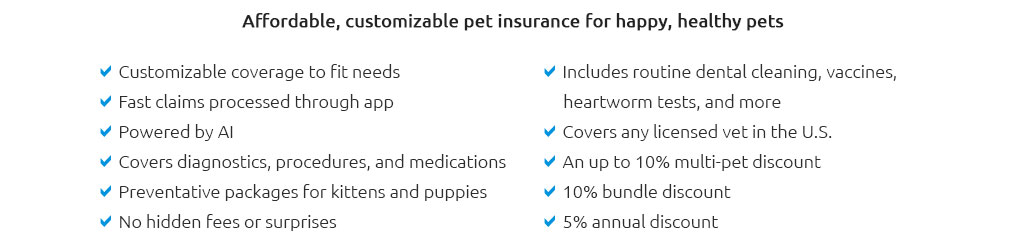

The Comprehensive Guide to Dog Pet Insurance: Expert Tips and AdviceIn today's world, where pet ownership has evolved into a cherished and integral part of family life, the concept of dog pet insurance has emerged as a pivotal aspect of responsible pet care. As any dog owner will attest, our canine companions are not just pets; they are beloved members of our families. With this in mind, ensuring their health and well-being becomes paramount, and pet insurance for dogs can play a crucial role in this endeavor. This guide seeks to provide a comprehensive overview of dog pet insurance, offering expert insights and advice to help you make informed decisions for your furry friend. Firstly, let us delve into the essence of dog pet insurance. At its core, pet insurance is akin to health insurance for humans, designed to mitigate the financial burden that comes with unforeseen veterinary expenses. From accidents to illnesses, insurance can cover a wide range of scenarios, allowing pet owners to focus on their pet's recovery rather than the cost of treatment. The peace of mind that comes with knowing you are financially prepared for unexpected events cannot be overstated. However, navigating the world of pet insurance can be daunting, with a myriad of options available, each with its own terms, conditions, and coverage levels. This is where expert guidance becomes invaluable. When considering dog pet insurance, it's essential to evaluate the coverage options meticulously. Generally, policies are categorized into accident-only, time-limited, maximum benefit, and lifetime coverage. Accident-only policies are the most basic, covering injuries resulting from accidents but not illnesses. While they are typically the most affordable, their limited scope may not be suitable for all pet owners. Time-limited policies, on the other hand, cover both accidents and illnesses but impose a time limit, usually twelve months, after which conditions are no longer covered. Maximum benefit policies provide a fixed amount of coverage for each condition, without time constraints, until the financial limit is reached. Finally, lifetime coverage is the most comprehensive, offering continuous coverage for ongoing conditions throughout the dog's life, as long as premiums are maintained. This option is particularly advantageous for breeds predisposed to certain hereditary conditions. Cost is undeniably a significant factor when selecting an insurance policy. Premiums vary based on factors such as the dog's age, breed, and pre-existing conditions. It's worth noting that some breeds are more prone to specific health issues, which can affect premium costs. For instance, breeds like Bulldogs and Pugs often have higher premiums due to their predisposition to respiratory and joint problems. Thus, it's crucial to balance the cost of premiums with the level of coverage provided. A cost-benefit analysis is recommended, taking into account the likelihood of claims and the potential out-of-pocket expenses without insurance. Beyond the financial aspects, the choice of insurer is equally critical. Opting for a reputable provider with a track record of transparent claims processing and excellent customer service can significantly enhance your experience. Reading reviews, seeking recommendations from fellow pet owners, and consulting your veterinarian can provide valuable insights into the reliability of different insurers. Additionally, it's important to be aware of exclusions and waiting periods in policies. Most insurers impose waiting periods before coverage kicks in, particularly for illnesses. Exclusions can also apply to pre-existing conditions, hereditary issues, and elective procedures. Understanding these nuances can prevent unwelcome surprises when making a claim. It is advisable to thoroughly read policy documents and seek clarification on any ambiguous terms before committing to a plan. In conclusion, dog pet insurance is an investment in the health and happiness of your furry friend. While it may require careful consideration and financial commitment, the benefits of being prepared for unexpected medical expenses are immeasurable. By evaluating coverage options, considering the specific needs of your dog, and choosing a reliable insurer, you can ensure that your beloved pet receives the care they deserve without compromising your financial stability. As pet ownership continues to grow, so too does the importance of staying well-informed about the options available to safeguard our canine companions' well-being. https://www.petco.com/shop/en/petcostore/insurance

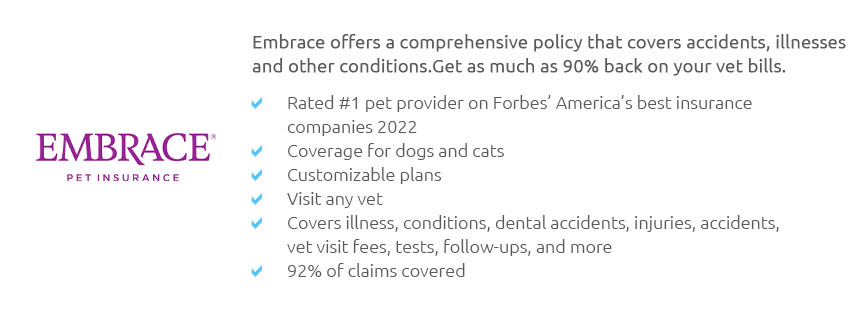

Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about ... https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ... https://www.progressive.com/pet-insurance/

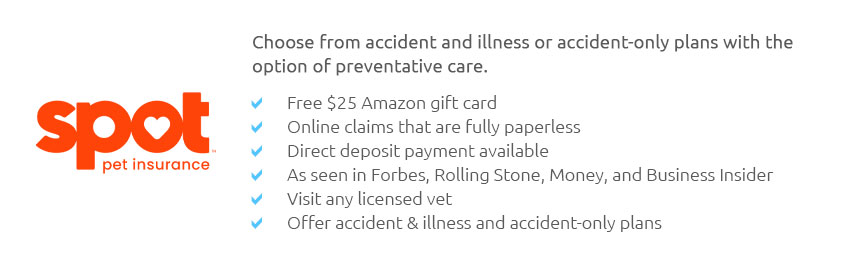

Accidents and illnesses. Companion Protect and Pets Best offer plans that cover both injuries and illnesses, no matter how serious. These comprehensive plans ...

|